Education & Research

View free daily Forex and CFD market commentary. Learn more about some of the fundamental and technical principles of trading.

Foreign Exchange trading commonly referred to as Forex or FX is the exchange of one currency for another currency at an agreed price. The Forex market is the largest financial market in the world with over $4.4 trillion traded daily1, compare this with the approximate $34.52 billion daily average volume of the NYSE Listed Shares of the NYSE Group2.

Over 85% of Forex trading is concentrated in the major currency pairs, which are combinations of the EUR, USD, JPY, GBP, CHF, AUD, CAD. The markets are at their most liquid during the London Trading Hours as over 38% of the global daily FX volume is transacted through the London Forex market3.

1,3 – TheCityUK global estimated daily FX turnover figures published 29.01.13

2 – Daily NYSE Group Volume in NYSE Listed, 2013 – www.nyxdata.com (6 month daily average Jan-June 2013)

What is Forex?

The FX market is the most liquid market in the world, making the cost of trading lower than other asset classes. Additionally, slippage is far less likely to occur than in other markets due to the depth of the market. In normal market conditions you should see no slippage on your trades or orders.

The Forex market is not traded on a central exchange or in a physical location, it is an Over the Counter (OTC) market where trading occurs through electronic systems and the telephone, 24 hours a day from Sunday evening till the close on Friday night (UK Time). This 24 hour market means that gapping is less likely and allows traders to react to political, economic, technical and fundamental factors as they happen rather than waiting for the market to open.

The growth of the internet enabled Forex to be offered to retail customers, allowing them to trade Forex in milliseconds through an online broker. This coupled with leverage has bought about huge growth in retail customers now trading Forex. It is estimated that Retail FX daily trading volumes have grown from $10 Billion in 2000 to over $200 Billion in 20124.

4 LeapRate’s report: Online Trading: Not just Retail and not just Forex anymore…Online Financial Trading grows up. December 2010 (www.nasdaq.com).

Forex is a margined (or leveraged) product. This means that you can trade Forex with an initial deposit that is a small percentage of the total transaction value. This means that the rate of return, the profit or loss from the initial capital outlay, is significantly higher than in traditional cash trading.

Most Forex brokers do not charge commission on Forex trades but make their money from the dealing spread, the difference between where a customer can buy (the offer) or sell (the bid). Due to the high liquidity and 24 hour market the spread in currency pairs is small meaning the cost of trading is low. Other trading costs are also low, the initial margin required to trade FX is small and the financing rates, the cost to borrow the notional transaction value overnight are also lower than other financial markets.

It is easy to take a positive or negative view of how a currency will perform against another, there are no selling (shorting) restrictions on free floating currencies.

The exchange rate is affected by a huge variety of political, economic, technical and fundamental factors meaning that it is constantly moving and adjusting price wise. This variety makes forex trading interesting and exciting as it causes volatility, as prices can change rapidly in response to many factors creating trading opportunities.

Forex Trading Examples

The FX Quote

Forex is quoted in how many units of the quote currency you receive for one unit of the base currency. For example, if you are looking to trade EURUSD, the Euro is the BASE currency and the USD is the QUOTE currency, also known as the counter currency. The EURUSD quote refers to the current amount of USD that you would receive for one Euro. When trading FX you are using your skills to anticipate if the value of the base currency, the first named currency, will rise or fall against the quote currency, the second named currency.

The FX Trade

If you are buying EUR as an opening trade then you are looking for the Euro to appreciate in value against the US Dollar, meaning your ONE Euro will be worth more USD at a later time then when you bought the Euro. If you are selling EUR as an opening trade then you are looking for the Euro to depreciate in value against the US Dollar, meaning your ONE Euro will be worth less USD at a later time then when you sold the Euro.

| Spot Forex EUR/USD | |

|---|---|

| Quote | 1.2810 / 1.2813 |

| Contract Size | € 100,000 |

| Trading Unit | 0.0001 |

| Opening SELL | Opening BUY |

| The quote means you can sell at: 1.2810 |

The quote means you can buy at: 1.2813 |

| Strategy: You believe the Euro will go lower against the USD, you sell 1 contract at 1.2810 | Strategy: You believe the Euro will go higher against the USD, you buy 1 contract at 1.2813 |

| Margin Requirement: You need to have the required margin of $1000 per contract available on your account | Margin Requirement: You need to have the required margin of $1000 per contract available on your account |

| Contract Size: 1 standard contract is €100,000 Trading Unit: 0.0001 meaning your profit/loss per contract will be $10 per 0.0001 price increment | Contract Size: 1 standard contract is €100,000 Trading Unit: 0.0001 meaning your profit/loss per contract will be $10 per 0.0001 price increment |

| The value of 1 contract in USD is Price x Contract Size 1.2810 x 100000 = $128100 |

The value of 1 contract in USD is Price x Contract Size 1.2813 x 100000 = $128130 |

| Interest Adjustment: With a position of Short EURO and Long USD there will be a debit of $1.31 per night | Interest Adjustment: With a position of Long EURO and Short USD there will be a debit of $2.24 per night |

| The following day the value of the EURO falls against the USD due to better than expected US Non-Farm Payroll Figures. EURUSD is now quoted at: 1.2740 / 1.2743 | |

| Closing BUY | Closing SELL |

| Strategy: You decide to take your profit and close the position by buying 1 contract at 1.2743 | Strategy: You decide to take your loss and close the position by selling 1 contract at 1.2740 |

| Profit Calculation: Value of sale in USD - Value of purchase in USD + interest adjustment | Profit Calculation: Value of sale in USD - Value of purchase in USD |

| $128100 - $127430 = $670 + -$1.31 = $668.69 (Profit) | $127400 - $128130 = -$730 + -$2.24 = $732.24 (Loss) |

Interest AdjustmentAs this is a rolling spot forex contract, for each night the position remains open you will be debited or credited an amount that reflects the difference between the interest received from holding the currency that is notionally being bought against the interest paid for borrowing the currency that is being notionally sold. An administration charge is then applied to the calculated interest rate. |

|

| Spot Metal XAU/USD | |

|---|---|

| Quote | 1570.7 / 1571.2 |

| Contract Size | 100 Troy Oz |

| Trading Unit | 0.1 |

| Opening SELL | Opening BUY |

| The quote means you can sell at: 1570.7 |

The quote means you can buy at: 1571.2 |

| Strategy: You believe the price of Gold will go lower, you sell 1 contract at 1570.7 | Strategy: You believe the price of Gold will go higher, you buy 1 contract at 1571.2 |

| Margin Requirement: You need to have the required margin of $1000 per contract available on your account | Margin Requirement: You need to have the required margin of $1000 per contract available on your account |

| Contract Size: 1 standard contract is 100 Troy Oz and the Trading Unit is $0.1 meaning your profit or loss per contract will be $10 per $0.1 price increment | Contract Size: 1 standard contract is 100 Troy Oz and the Trading Unit is $0.1 meaning your profit or loss per contract will be $10 per $0.1 price increment |

| The value of 1 contract in USD is Price x Contract Size 1570.7 x 100 = $157070 |

The value of 1 contract in USD is Price x Contract Size 1571.2 x 100 = $157120 |

| Interest Adjustment: Position not held overnight no interest adjustment | Interest Adjustment: Position not held overnight no interest adjustment |

| Later that day the price of gold falls on rumours of a large central bank sell order and our spot GOLD quote is 1567.5 / 1568.0 | |

| Closing BUY | Closing SELL |

| Strategy: You decide to take your profit and close the position by buying 1 contract at 1568.0 | Strategy: You decide to take your loss and close the position by selling 1 contract at 1567.5 |

| Profit Calculation: Value of sale in USD - Value of purchase in USD | Profit Calculation: Value of sale in USD - Value of purchase in USD |

| $157070 - $156800 = $270 | $156750 - $157120 = -$370 |

Interest AdjustmentAs this is a rolling spot gold contract, for each night the position remains open you will be debited or credited an amount that reflects the difference between the interest received from holding the currency or commodity that is notionally being bought against the interest paid for borrowing the currency or commodity that is being notionally sold. An administration charge is then applied to the calculated interest rate. |

|

What are CFDs?

A CFD is all of the following:

A CFD (Contract for Difference) is an agreement to exchange the difference in value of the underlying instrument between the time at which the contract is opened and the time at which it is closed.

Geared products like CFDs can help you make the most effective use of your investment capital, but it is important to appreciate that the amount you could gain or lose relative to your initial investment is greater for geared products than for non-geared products.

CFDs are margin traded products. You only need to deposit a fraction of the notional trade value of the contract allowing you to make a much larger investment than in traditional cash markets. Your profit or loss is determined by the difference between the price you buy at and the price you sell at. Margin levels required will vary between different CFD products.

CFD Trading Examples

| S&P 500 | |

|---|---|

| Quote | 1550.5 / 1551 |

| Contract Size | $100 per One Index Point |

| Trading Unit | 1 Index Point |

| Strategy: You believe the S&P 500 Index will go lower you sell 1 contract at 1550.5 | Strategy: You believe the S&P 500 Index will go higher you buy 1 contract at 1551 |

| Opening SELL | Opening BUY |

| The quote means you can sell at: 1550.5 |

The quote means you can buy at: 1551.0 |

| Margin Requirement: You need to have the required margin of $4,000 per contract available on your account | Margin Requirement: You need to have the required margin of $4,000 per contract available on your account |

| The Contract Size of 1 contract is $100 per One Index Point meaning your profit or loss per contract will be $100 per one Index Point price increment | The Contract Size of 1 contract is $100 per One Index Point meaning your profit or loss per contract will be $100 per one Index Point price increment |

| The value of 1 contract is Price x Contract Size (1550.5 x $100) = $155,050 | The value of 1 contract is Price x Contract Size (1551.0 x $100) = $155,100 |

| Two days later the market rises on better than expected Non-Farm Payroll Figures and the S&P price quote moves to 1554.5 / 1555. You decide to close your open trading position. | |

| Closing BUY | Closing SELL |

| You decide to close the position by placing an equal and opposite trade to the opening trade, in this case buying 1 contract at 1555.0 | You decide to close the position by placing an equal and opposite trade to the opening trade, in this case by selling 1 contract at 1554.5 |

| Your profit is calculated as follows: Closing Price - Opening Price / Trading Unit x Contract Size x Number of Contracts | Your profit is calculated as follows: Closing Price - Opening Price / Trading Unit x Contract Size x Number of Contracts |

| 1555.0 - 1550.5 / 1 x $100 x -1 = -$450 (Loss) | 1554.5 - 1551.0 / 1 x $100 x 1 = $350 (Profit) |

| As this is a Futures (expiring) CFD there is no commission or overnight financing charges, all costs are in the competitive dealing spread | |

| Commodity Future CFD Wheat May 2013 CFD | |

|---|---|

| Quote | 691.75 / 692.25 |

| Contract Size | 5000 bushels |

| Trading Unit | 0.25 cents |

| Opening SELL | Opening BUY |

| The quote means you can sell at: 691.75 |

The quote means you can buy at: 692.25 |

| Strategy: You believe the price of Wheat will go lower, you sell 1 contract at 691.75 cents | Strategy: You believe the price of Wheat will go higher, you buy 1 contract at 692.25 cents |

| You need to have the required margin of $2500 per contract available on your account | You need to have the required margin of $2500 per contract available on your account |

| The Contract Size of 1 contract is 5000 bushel meaning your profit or loss per contract will be $12.50 per 0.25cents price increment | The Contract Size of 1 contract is 5000 bushel meaning your profit or loss per contract will be $12.50 per 0.25cents price increment |

| The value of 1 contract is Price x Contract Size (691.75 cents x 5000) = $34587.50 |

The value of 1 contract is Price x Contract Size (692.25 cents x 5000) = $34612.50 |

| The following week a bad weather report comes out sending wheat prices higher and our quote is 699.0 / 699.5 | |

| Closing BUY | Closing SELL |

| You decide to take your loss and close the position by buying 1 contract at 699.5 | You decide to take your profit and close the position by selling 1 contract at 699.0 |

| Your loss is calculated as follows: Value of sale in USD - Value of purchase in USD | Your profit is calculated as follows: Value of sale in USD - Value of purchase in USD |

| Loss $34587.50 - $34975 = -$387.50 | Profit $34950.00 - $34612.50 = $337.50 |

| As this is a Futures (expiring) CFD there is no commission or overnight financing charges, all costs are in the competitive dealing spread | |

Open a Forex and CFD trading account now.

Open a Forex and CFD trading account now.

Types of Orders

To assist our customers in managing their trading risk we offer a wide range of different order types. These strategy orders can help customers manage the risk on their open positions or enable them to open new positions if the market reaches certain levels.

What is a Market order?

A Market order is an instruction to buy or sell at the current market price. For example, EURUSD is currently trading at 1.3040 / 1.3043, if you want to buy EURUSD at the current price of 1.3043 you can simply click the Buy/Ask Price button and your order will be executed instantly at this price.

What are Limit and Stop orders?

A Limit or Stop order is an instruction to buy or sell if the market price reaches a pre-defined level. The order essentially contains two variables, the price and the duration. The duration is the time period that the customer wishes the order to remain active, after which it will expire.

Limit order:This order is an instruction to either BUY BELOW or SELL ABOVE the current market price, if the pre-defined price is reached during the order duration.

Stop order:This order is an instruction to either BUY ABOVE or SELL BELOW the current market price, if the pre-defined price is reached during the order duration.

Pre-defined order levels must be placed a certain minimum distance away from the current market price. These minimum levels will vary by instrument.

What are Limit Settle orders?

There are two types of Limit Settle orders: Linked Limit and Stop Loss. Limit orders (take profit) or stop loss orders (limit loss) are pending orders that are linked to open positions whose primary purpose is to close an existing open position at a profit or for a loss. These orders can be attached to a market order at the point of placing the market order or after the position has been opened. From the MetaTrader4 platform, it is possible to set both a limit and a stop loss order at the same time. These orders can be viewed, amended or cancelled at any time. If the open position is closed then any Limit Settle orders that are linked to the position will automatically be cancelled.

What are Limit Open orders?

There are two types of Limit Open orders: Limit Open and Stop Open. These are limit or stop orders that are designed to open a new position when the price reaches a pre-defined level. If you want to SELL below or BUY above the current price you would place a Stop order and if you wanted to BUY below or SELL above the current price you would place a limit order. These orders can be viewed, amended or cancelled at any time.

Hedging facility

Clients have access to a hedging facility within the MetaTrader 4 platform. A hedge trade is a way of insuring an investment against future risk. So if you have an open Forex position which you feel has encouraging future prospects but you anticipate the currency pair may reverse against you in the short term, you may want to neutralize this short term risk by hedging your position by making an opposite trade to the existing open position. This hedging function enables CCC traders hold a long and short position in the same instrument at the same time.

Order Duration

It is possible to choose different lengths of time that an order remains active in the market.

Daily:A Daily order remains active in the market until the end of the trading day.

GTF (Good ‘til Friday):A GTF order remains active in the market until the end of trading each week.

GTC (Good ‘til Cancelled): A GTC order remains active in the market indefinitely until either the price is reached and the trade executed or the client manually cancels the order.

Advanced Strategy Orders

OCO (One Cancels the Other)

An OCO is an order that comprises of both a limit and stop order. If one of the orders is executed the other order will be cancelled. OCO orders can be either Limit Open or Limit Settle.

IF-Done Limit Order

An ‘if-done’ limit order allows you to preset the Take Profit and the Stop Loss price for your limit entry order. This is an easy way to place stops and limits on a trade that you anticipate may be opened in the future if a certain price target is reached. If your market entry order is triggered, the If-Done order automatically attaches your pre-defined Take Profit and Stop Loss orders to the live open position.

Trading Order Examples

Limit Settle

OCO Limit Price and Stop Price

You open a long position in EURUSD at 1.3043 and decide that you want to take profits if the price reaches 1.3098 but also want to limit your losses if the price trades at 1.3022. You can place an OCO Limit Settle order, above the market, with a Limit Price at 1.3098 and a Stop Price at 1.3022, below the market. If the price reaches 1.3098 first then the open position will be closed at 1.3098 and the Stop order cancelled. If the price was to reach the 1.3022 level first then the open position will be closed at 1.3022 and the limit order cancelled. If the open position is closed either manually or as a result of the order expiring, then both Limit and Stop orders will automatically be cancelled.

Limit Open

Limit Price

EURUSD is currently trading at 1.3040 / 1.3043, and you want to buy if the price reaches 1.3020. You can place a limit order at 1.3020 and if the price reaches that level the trading system will automatically execute the buy order at the best available limit price.

Stop Price

EURUSD is currently trading at 1.3040 / 1.3043, and you want to sell if the price reaches 1.3017. You can place a stop order at 1.3017 and if the price reaches that level the trading system will automatically execute the sell order at the best available limit price.

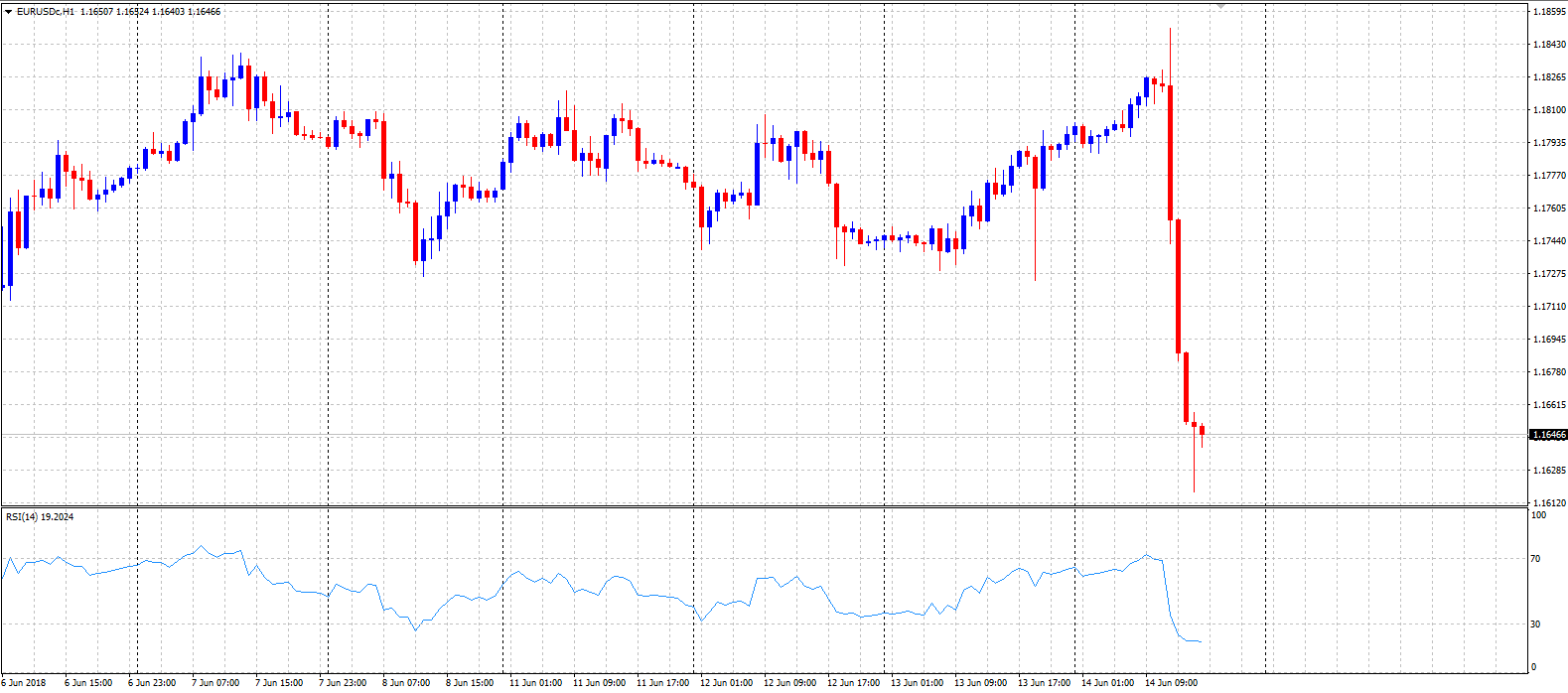

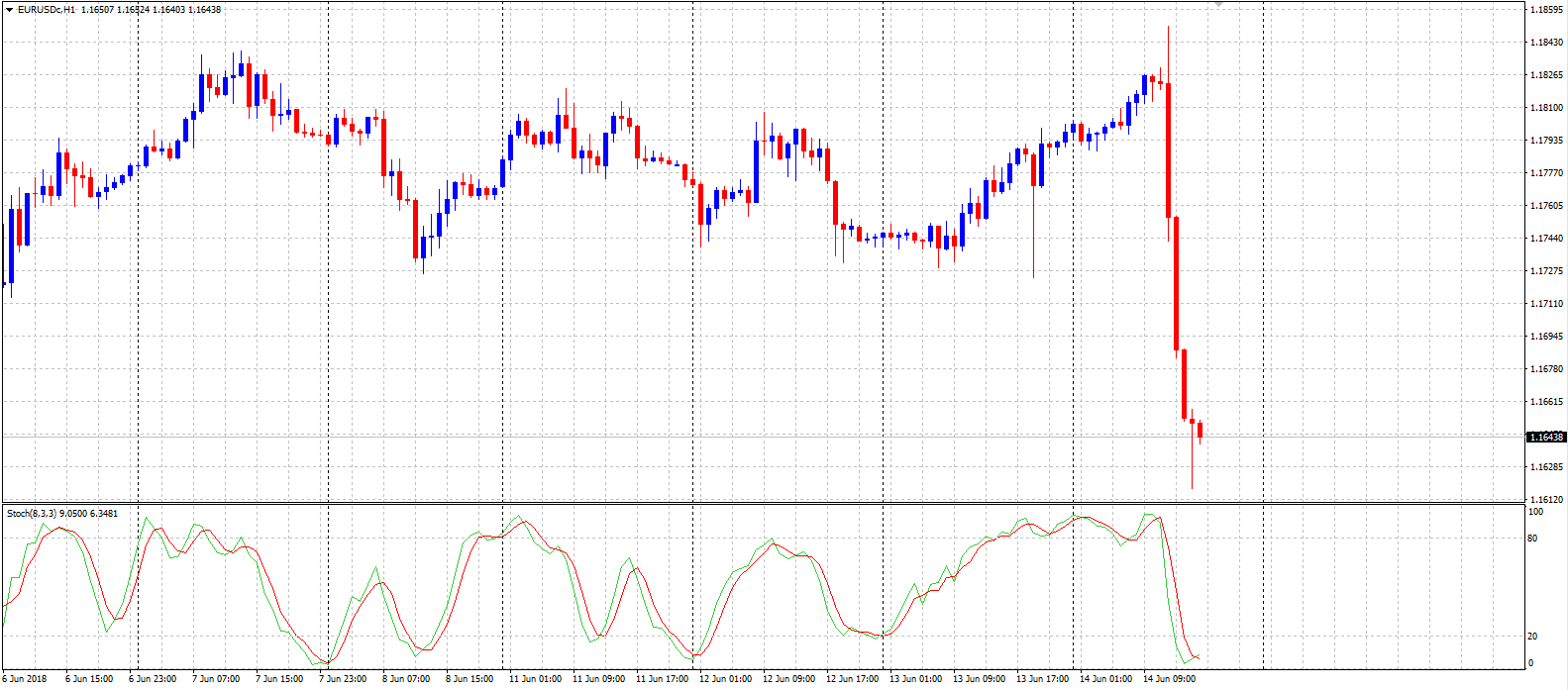

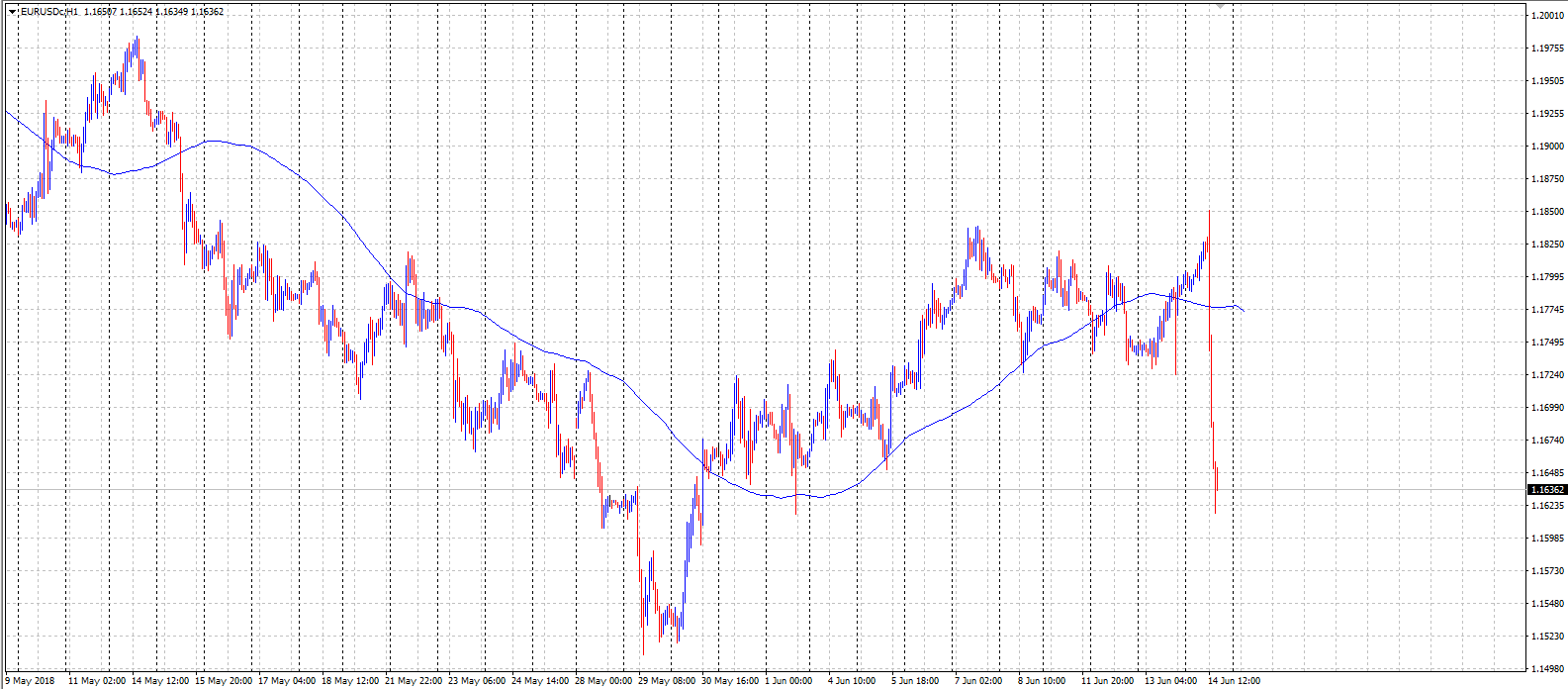

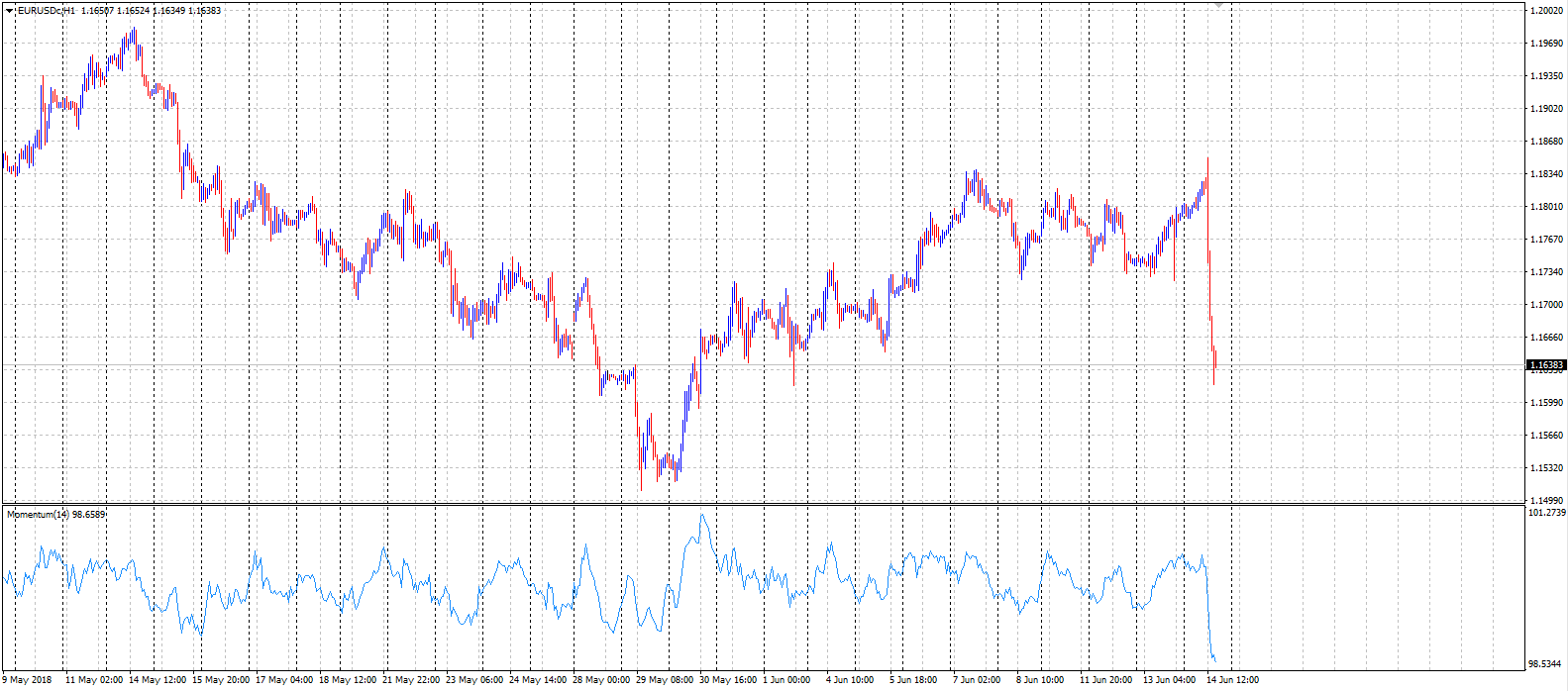

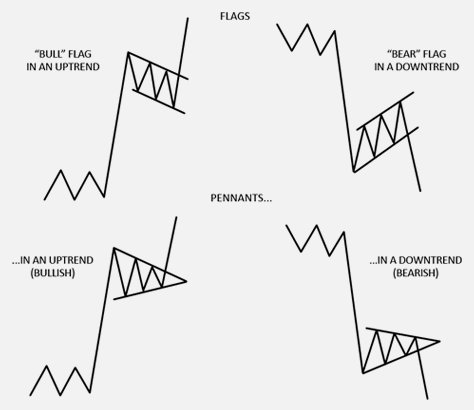

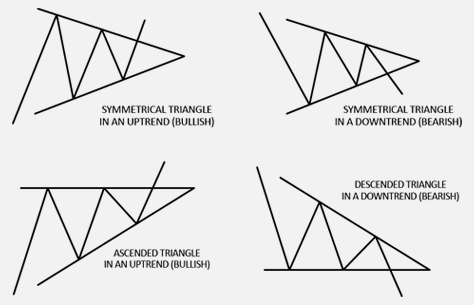

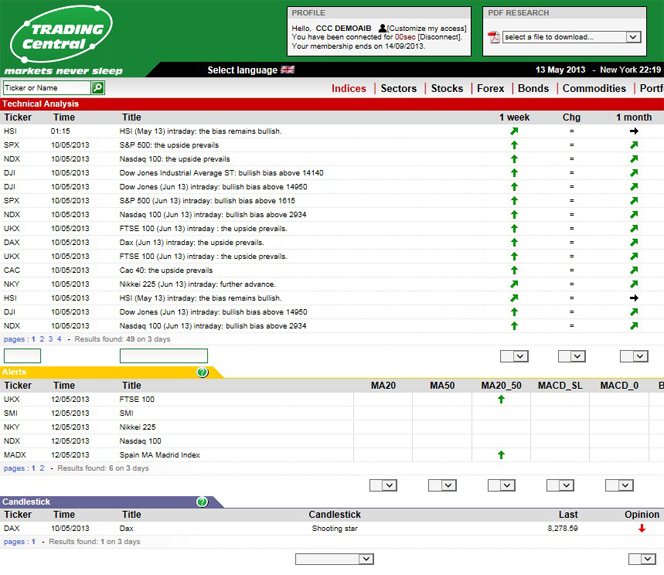

Understanding Technical Analysis

Technical analysis is the examination of past price movements to forecast future price direction. It is sometimes referred to as chartist analysis because it relies almost exclusively on charts for analysis.

Technical analysis is applicable to foreign currencies, stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. Price refers to any combination of the open, high, low or close for a given commodity/security over a specific timeframe.

The time frame can be based on intraday (tick, 5-minute, 15-minute or hourly), daily, weekly or monthly price data and last a few hours or many years. In addition, some technical analysts include volume and/or open interest figures with their study of price action.

The charting package provides users with 20 key technical analysis indicators such as Moving Averages, Bollinger Bands and Volumes.